Find consumer tips on everything from credit to home safety to travelling on a budget and so much more!

Take Care of Your Baby with Union Plus Auto Insurance

*Savings based on our 2016 countrywide research of new call center customers’ annual average savings in 2015.

**Delay is not automatic. Certain restrictions apply. Policyholder must request delay of payment by calling 1-800-GETMET8. Delayed premium payment is expected when hold is lifted. 1 See policy for restrictions. Not available in all states. 2 Not available in all states. In NY, drivers must pay a state-required minimum deductible before using this benefit. MetLife Auto & Home is a brand of Metropolitan Property and Casualty Insurance Company and its affiliates: Economy Preferred Insurance Company, Metropolitan Casualty Insurance Company, Metropolitan Direct Property and Casualty Insurance Company (CA Certified of Authority: 6730; Warwick, RI) Metropolitan General Insurance Company, Metropolitan Group Property and Casualty Insurance Company (CA COA: 6393; Warwick, RI), and Metropolitan Lloyds Insurance Company of Texas, all with administrative home offices in Warwick, RI. Coverage, rates, discounts, and policy features vary by state and product, and are available in most states to those who qualify. Met P&C®, MetCasSM, and MetGenSM, are licensed in MN.

© 2018 MetLife Auto & Home

L0118501934[exp1220][All States][DC]

When you’re ready to protect your vehicle from fender to bumper, look to Union Plus Auto Insurance provided through MetLife Auto & Home®. Check out this video to see what the program has to offer you.

Five Popular New Scams on the Rise

It seems that as long as people exist, there will be scams. Methods change with time, but at their heart, scams will always be about preying on your fears. The most effective scams are the ones that successfully use your desire to help others and stay out of trouble against you.

The “Can You Hear Me?” Scam

This particular scam started picking up steam late last year. It’s essentially a robocall (automated dialer) with a recording that asks something to the effect of, “Can you hear me?” The question itself may change, but it’s usually designed to elicit a “Yes” from whoever answers the phone. The scammer wants to get a recording of you saying “yes”, which they can then use to initiate calls with financial institutions and creditors, in the hopes of accessing your accounts.

Just hang up. If able, avoid calls from numbers you don’t recognize.

The FBI Calling Scam

This scam comes in many different shades and hues, but it basically amounts to a scammer calling from an official seeming number and demanding a payment.

Recently, there has been a rash of calls from scammers spoofing local FBI field office phone numbers. Based on what your caller ID is telling you, it looks like a legitimate call from the FBI. So when the person on the line starts demanding that you make an immediate money order payment on old student loans or unpaid parking tickets or else risk being arrested, you’d be forgiven for rushing to do as they say.

These kinds of calls can also come from places like the police or the IRS. Of course, the FBI, the IRS, and your local police department are not debt collectors. They will never call you and ask for a payment. So feel free to hang up.

As a general rule of thumb, never make a payment or give out sensitive information on a phone call you did not initiate. If you’re curious about the debt mentioned, follow up with your creditor directly. Just don’t use the phone number the caller provides – look up the phone number from a credible source.

Unsolicited Check Scams

Recently, consumers in multiple states have received checks in the mail, along with instructions. The instructions are for a “mystery shopper” program (most often at Walmart), and direct recipients to cash the checks, use the money to purchase a MoneyGram at a particular store, and then complete a survey on the experience.

Financial institutions can only hold funds for so long – unfortunately, not long enough to verify that the check is a fake. By then you’ll have sent a MoneyGram to the scammers and you’ll be on the hook with your bank or credit union in the amount of the bounced check.

Mystery shopper programs do exist, but they don’t typically hire strangers through the mail. There are a lot of variations on this scam, so make it a point to never, ever cash a check from a stranger, especially if that check comes on the condition that you “repay” some amount or wire funds to a third party.

Charity Scams

Scammers aren’t ones for ethics. Sadly, that extends to bilking money out of good citizens in the name of legitimate charities. Consumers in Indiana were recently victimized by a series of phone calls from scammers claiming to be soliciting donations on behalf of the Indiana Breast Cancer Awareness Trust. Some scammers even solicit donations face-to-face, pretending to represent a charity.

The safest way to support a charity is to contact them directly, either through their website or a publicly available phone number.

The Fake Kidnapping Scam

As noted above, scammers are all about preying on your emotions. In this extremely unpleasant scam, thieves will call and claim that someone you know (usually a child) has been kidnapped and demand that you make a payment immediately. Scammers gather real information by monitoring your online social accounts. They will demand that you act quickly and not contact the police.

This scam can take a few other forms, but the central idea is that someone you know is in trouble and you need to make a payment right away. The fact that they won’t let you off the phone without a payment is a telltale sign that this is a scam. Step back from the situation and check on the person in question if you’re concerned. Otherwise, just hang up.

Whenever you encounter a scam, don’t hesitate to report it. You can use the Better Business Bureau Scam Tracker to submit scams and the Federal Trade Commission’s Scam Alert page to monitor newly reported scams.

Union Plus Debt Management

Did you know that union members can get free budgeting advice from certified consumer credit counseling advisers? It's true! For union members who need additional assistance in eliminating debt, you can receive an enrollment fee waiver for a Debt Management Plan (DMP) available through Union Plus Credit Counseling.

Scams are like fads, in a way – they gain in popularity, overexpose themselves, lose steam, and eventually return in a new form. These are some of the most prevalent scams making the rounds today. Be on alert.

Biggest Garage Sale Mistakes

- Don’t Assume You Should Have One: The first thing to understand – garage sales are a lot of work – make sure it’s going to be worth your while. Look at the items you need to sell and do a quick estimate of how much you might make. Estimate that you might only sell 40-60% of your stuff. Be realistic with what you think you might get for high-valued items by looking at sites like Ebay for historical sale data of similar items. Look at what kind of options you might have to sell your high-valued items locally – either at thrift stores or online. Look at the pros and cons of doing that versus having a sale.

- Don’t Go Alone: If you can pair up with someone else or a neighborhood sale, you can split the responsibilities and cost. Especially if your neighborhood plans to do the advertising for you. Leverage the traffic that might be coming through your area for local sales.

- Don’t Drop Prices Early: For your high-value items, be sure you get out of them what you need in order to make the sale worth it. On your first day, be sure to take down the name and number of people who are seriously interested. Let them know that later in the day or the next day – if it still hasn’t sold, you might give them a call to negotiate further.

- Be Descriptive: In all of your marketing – signs, advertising and social media – offer up details on what you’re selling. Include brand names, large items, categories, etc. The more descriptive, the bigger the chance someone might see something of interest that drives them to your sale

- Use Social Media: Be sure to post pictures of your sale items to your social media channels (encourage friends/family to share) – you never know, you might get a few sales by just posting a few pictures. If anything, it’s free advertising and might get some more people to your sale!

If you’re selling items to eventually move – be sure to remember the Union Plus Real Estate Rewards Program when you’re ready to find your next home. You can earn $500 cash back for every $100,000 in home value when you use a real estate agent, approved by SIRVA, to sell or buy a home.

Certain state restrictions apply to the real estate cash back program. To qualify for cash back reward (in cash back states), you must use a SIRVA-referred real estate agent. Program designed as a referral service to provide you the opportunity to select a real estate agent to meet your needs. You must evaluate the brokers, agents and their services and make selections and decisions based upon your best judgment, interest, priorities and concerns. Call 800-284-9756 or visit www.UP-RealEstateRewards.com for important program details and state restrictions.

SIRVA is an independent provider of services. Union Plus is not affiliated with SIRVA and does not manage SIRVA or its programs. SIRVA is paying Union Plus for advertising services including dissemination of information about SIRVA and its programs to participating unions and their members as well as participation in Union Plus events and programs.

No referral, recommendation, service representation or exclusivity requirement is intended by the Union Plus’s mention or dissemination of the SIRVA name and delivery of this information to participating union members.

It’s that time of year again; time to think about spring cleaning. If you have enough to get rid of, you might be considering a garage sale. Before you jump in headfirst, be smart and learn from others’ past mistakes.

How a Reverse Mortgage Works

The following is presented for informational purposes only, and should not be construed as legal advice.

A reverse mortgage can be a tremendous help to seniors looking for additional income during their retirement years. But there are drawbacks, and the concept itself is somewhat complicated. As the baby boomer generation continues to ease into retirement, it’s very likely that the demand for reverse mortgages will only increase.

What Is a Reverse Mortgage?

A reverse mortgage (or Home Equity Conversion Loan, HECM) is a loan that a credit agency takes out against your home, while you're still living in it. Despite the name, they aren't exactly the reverse of a traditional mortgage. The lender is not attempting to buy the property. Instead, the lender is simply loaning money which is secured by the home's equity. When the homeowner/borrower dies, permanently moves out, or sells their home the reverse mortgage comes due and must be paid in full, usually with the proceeds for the sale of the property. Terms can vary, but some borrowers choose to get a lump sum payment, while others choose a line of credit or periodic payments.

Reverse mortgages are available from private lenders, from the U.S. Department of Housing and Urban Development (HUD), from some nonprofit organizations, and from some state and national government programs. Homeowners retain the title to their property, and therefore need to continue making insurance and tax payments. They are only available to homeowners aged 62 and older (spouses can be under 62 and have the option to maintain the loan after the primary borrower dies).

How Much Do You Get for a Reverse Mortgage?

The amount of money you get from a reverse mortgage depends upon the current market value of your home. However, you shouldn’t expect to receive the full value of your home. Instead, you’ll likely get a percentage of that value.

Keep in mind that although you will no longer be required to make payments on your home, interest on your reverse mortgage will accrue every month. In time, the balance owed may even come to exceed the value of the home (especially if home values drop). In many cases, borrowers (or their surviving heirs) are not required to repay these overages, but that’s not a guarantee, so you’ll always want to make sure you fully understand the terms of the mortgage agreement.

Should I Consider a Reverse Mortgage?

Many seniors benefit from taking out a reverse mortgage, however, it is a big decision that should be made carefully. First, consider all of your options–there may be something less expensive that will work better. Reverse mortgages usually have up-front fees, so they aren’t always the best option in the short-term. Also, if you take out a reverse mortgage, you are giving up a measure of control over what is likely your most valuable asset.

Reverse mortgages are secured, so you may not want to use a reverse mortgage as a tool to pay down unsecured debt. In other words, you’ll need to take some time to consider whether or not you want to use your home equity. Talking to heirs or a financial planner might help you with the decision making process.

If you do decide to take out a reverse mortgage, do some research to find a highly rated lender that offers competitive rates. You will also need to attend a reverse mortgage counseling session offered by a HUD-approved agency, such as Money Management International (MMI). Visit MMI's Reverse Mortgage resources page to learn more about the counseling process.

Union Plus Credit Counseling

Union members can get a no-obligation money and credit assessment from certified, experienced consumer credit counselors though Union Plus Credit Counseling. Powered by the non-profit Money Management International (MMI), your free session will cover a complete financial review, assistance in budgeting, advice for working with creditors, and more.

For those approaching retirement and considering their financial outlook, the following information can help you decide if a reverse mortgage is right for you.

Freedom to Stream with AT&T's Unlimited Data Plans

Choose from AT&T Unlimited Plus or AT&T Unlimited Choice, and get the following:

AT&T Unlimited PlusSM AT&T Unlimited ChoiceSM

|

|

|

|

|

|

|

|

|

|

|

|

Not going the unlimited route? As a union member, you can save 15% on the monthly service charge of qualified wireless plans6 (excludes unlimited data plans). You can also save 20% on select accessories7 and get the $25 activation fee waived on select devices8.

Not yet an AT&T customer? For a limited time, get up to $650 in bill credits9 when you switch to AT&T, trade in your current smartphone and buy a new one on AT&T Next.

When you visit an AT&T store, you’ll be helped by a fellow union member. Be sure to reference Discount Code 3508840, even if you choose an unlimited data plan, to ensure you can take advantage of the union-member specific benefits, such as the 20% accessory discount and the $25 activation fee waiver. Ask your AT&T store rep which plan is best for you.

Remember that when you choose AT&T, you’re choosing to support the more than 150,000 union members employed there.

AT&T is the only nationwide unionized wireless carrier.

To find a store, or get additional information, visit unionplus.org/att.

1AT&T UNLIMITED CHOICESM: Data speed limited to a max of 3Mbps. Plan is not eligible for Stream Saver, but for content we can identify as video, speed will be at a max of 1.5Mbps at Standard Definition quality (about 480p). Data and video speeds will be capped at amounts shown above, regardless of the network your device is on (for example 4G LTE, 4G or 3G). Tethering and mobile hotspot use prohibited (except for these products: Connected Cars, Hot Spots, and Wireless Home Phone and Internet).

AT&T UNLIMITED PLUSSM: Includes the Stream Saver feature which allows you to save data on content it recognizes as video by streaming higher definition video in Standard Definition quality (about 480p) on compatible devices (unless the video provider has opted out). AT&T will activate the feature for you. Check your account online to see if the feature is active. Once active, you can turn it off or back on at any time at att.com/myatt or call 611. Stream Saver will not recognize all video content. Ability to stream and video resolution may vary, and be affected by other factors. Restrictions apply. See att.com/streamsaver for more details. HD Video: You can turn Stream Saver off at any time to enjoy access to High Definition video streaming, if and when available. Tethering and Mobile Hotspot: Includes up to 10GB per line per month. After 10GB, tethering speed will be slowed to a max of 128Kbps for the rest of the bill cycle (except for these products: Connected Cars, Hot Spots, and Wireless Home Phone and Internet.). Except for those products, all tethering data usage, including sponsored data if tethered, will be impacted and will not be fully functional.

AT&T UNLIMITED CHOICE & PLUS PLANS: For consumers only. Plan includes unlimited talk, text, and data, and Roam North America feature. Pricing: Includes monthly plan charge and per device monthly access charge. AutoPay & Paperless Billing discount: $5 (off single line) or $10 (off multiline) per month discount off your plan charge requires being active and enrolled in paperless billing and AutoPay (excludes credits cards). Discount will start within 2 bill cycles. Offer subject to change and may be discontinued at any time. Devices: Sold separately. Limits: Select wireless devices only. 10 devices per plan. UNLIMITED DATA: For use in the United States, Puerto Rico and the U.S. Virgin Islands (the “Domestic Coverage Area” or “DCA”). Data Restrictions: After 22GB of any data usage on a line in a bill cycle, AT&T may slow the data on that line during periods of network congestion for the remainder of that cycle. See att.com/broadbandinfo for details on AT&T network management policies. UNLIMITED TALK: For phones only. Includes calls within the DCA. Service may be terminated for excessive roaming (see Wireless Customer Agreement at att.com/wca). Unlimited Talk to Canada and Mexico: For phones only. Includes unlimited International Long Distance (ILD) calling from DCA to Mexico and Canada. You may be charged for calls to special or premium service numbers. Calls to Other Countries: Includes ILD service that can be used to call countries other than Canada and Mexico. Per minute pay-per-use rates apply unless have an ILD service package. Rates subject to change without notice. For rates, see att.com/worldconnect. UNLIMITED TEXT: Standard Messaging – Phones only. Includes unlimited messages up to 1MB in size within DCA to more than 190 countries for text messages and 120 countries for picture and video messages. AT&T may add, change, and remove included countries at its discretion without notice. Messages sent through applications may incur data or other charges. See att.com/text2world for details. Advanced Messaging – Sender and recipient(s) must be AT&T postpaid wireless customers with HD Voice accounts, capable devices, have their devices turned on and be within the AT&T-owned and operated DCA (excludes third-party coverage). Includes unlimited messages up to 10MB in size. Other restrictions apply and can be found at att.com/advancedmessaging. Discounts: Plans may not be eligible for offers, credits, or discounts.

ROAM NORTH AMERICA FEATURE: Data: allows domestic plan data usage in Mexico/Canada. Talk: Phones only. Includes calls within Mexico/Canada and from Mexico/Canada to the U.S., Puerto Rico, and U.S. Virgin Islands (collectively with Mexico & Canada, the North America Coverage Area “NACA”). You may be charged for calls to special or premium service numbers. Calls to other countries: International long distance pay-per-use rates apply to calls from Mexico or Canada to countries outside the NACA unless have an ILD service package. Rates subject to change without notice. For rates, see att.com/wcv. Text: Standard Messaging – Phones only. Includes unlimited messages up to 1MB in size within Mexico/Canada and from Mexico/Canada to more than 190 countries for text messages and 120 countries for picture and video messages. AT&T may add, change, and remove included countries at its discretion without notice. Messages sent through applications may incur data or other charges. Visit att.com/text2world for details. Advanced Messaging – not available for use in Mexico or Canada. Usage Restriction: If voice, text or data use in Mexico and/or Canada exceeds 50% of total voice, text or data use for two consecutive months, feature may be removed. Device Restrictions: Service not available on select connected devices, wearables, & connected cars.

2Claim based on the Nielsen Certified Data Network Score. Score includes data reported by wireless consumers in the Nielsen Mobile Insights survey, network measurements from Nielsen Mobile Performance and Nielsen Drive Test Benchmarks for Q2+Q3 2016 across 121 markets.

3AT&T UNLIMITED PLUS VIDEO LOYALTY CREDIT: Limited Time Offer. Excludes Puerto Rico & U.S. Virgin Islands. Avail. to residential U.S. customers. Requires qualifying, AT&T video service and AT&T Unlimited Plus wireless plan (min. $90/mo. after autopay and paperless bill discount). See att.com/unlimited for plan details. Qualifying Video Service: Requires eligible base programming packages from DIRECTV (installation must be complete) or DIRECTV NOW. For new DIRECTV Satellite customers, 24-mo. TV agmt & equip. lease req'd. Early Termination Fee (up to $480), Equipment Non-Return & add'l fees apply. Credit card (except MA & PA) & credit approval req'd. See directv.com or directvnow.com for details on these services. Exclusions: Select promotional, trial and other video packages are not elig. for offer. Credit: Applied as a $25 credit to qualifying video service account each billing period. Credit begins 2-3 billing periods after enrolling in AT&T Unlimited Plus. Credit may not exceed monthly recurring charge of your base package. First time credit will include all credits earned since meeting offer requirements. Cancellation of AT&T Unlimited Plus will result in discontinuance of credit. If you have an outstanding credit balance after cancel DIRECTV NOW account, the credit balance may be applied to your wireless service. Existing Video Service Customers: Customers with two or more qualifying video services must elect the service to be credited or discount is automatically applied to the account AT&T chooses. Limits: One Video Loyalty Credit per wireless account. May not be stackable w/other offers, credits or discounts. Offer, programming, pricing, terms and conditions subject to change and may be discontinued at any time without notice.

GENERAL WIRELESS SERVICE: Subject to Wireless Customer Agmt (att.com/wca). Services are not for resale. Credit approval, activation/upgrade fee (up to $45), other charges & deposit per line may apply. Other Monthly Charges/Line: May include taxes, federal & state universal service charges, Regulatory Cost Recovery Charge (up to $1.25), gross receipts surcharge, Administrative Fee, & other government assessments which are not government required charges. See att.com/additionalcharges for details on fees & charges. Pricing, promotions, & terms subject to change & may be modified or terminated at any time without notice. Coverage & service not available everywhere. You get an off-net (roaming) usage allowance for each service. If you exceed the allowance, your service(s) may be restricted or terminated. Other restrictions apply & may result in service termination. AT&T service is subject to AT&T Network management policies, see att.com/broadbandinfo for details.

4Roaming feature maybe removed if voice, text, or data usage in Mexico and/or Canada exceeds 50% of total voice, text, or data usage for 2 consecutive months.

5Discount is $5/mo. on single lines & $10/mo. on multi-lines. AutoPay excludes credit cards. Discount starts in 1 to 2 bill cycles. Taxes, monthly & other charges are additional. Usage, speed, and other restrictions apply.

615% ON THE MONTHLY SERVICE CHARGE of QUALIFIED WIRELESS PLANS: Available only to current members of qualified AFL-CIO member unions, other authorized individuals associated with eligible unions and other sponsoring organizations with a qualifying agreement. Must provide acceptable proof of union membership such as a membership card from your local union, a pay stub showing dues deduction or the Union Plus Member Discount Card and subscribe to service under an individual account for which the member is personally liable. Offer contingent upon in-store verification of union member status. Discount subject to agreement between Union Privilege and AT&T and may be interrupted, changed or discontinued without notice. Discount applies only to recurring monthly service charge of qualified voice and data plans, not overages. Not available with unlimited voice or unlimited data plans. For Family Talk, applies only to primary line. For all Mobile Share plans, applies only to monthly plan charge of plans with 1GB or more, not to additional monthly device access charges. Additional restrictions apply. May take up to 2 bill cycles after eligibility confirmed and will not apply to prior charges. Applied after application of any available credit. May not be combined with other service discounts. Visit unionplus.org/att or contact AT&T at 800-331-0500 for details.

720% OFF SELECT ACCESSORIES: AT&T will apply the Accessory Discount to the prices of select Accessories available through AT&T, which may be modified by AT&T from time to time. The term "Accessory" or "Accessories" means supplementary parts for Equipment (e.g. batteries, cases, earbuds). The Accessory Discount will not apply to Accessories purchased for use with datacentric Equipment such as modems, replacement SIM cards and car kits or to Apple-branded Accessories, and the Accessory. Discount may not be combined with any other promotional pricing or offer.

8$25 waived activation fee on select devices.

9SWITCH TO AT&T: Each line reqs an eligible port-in, trade-in, purchase, svc & final bill submission. Credits received may not equal all costs of switching. Elig. port-in: From eligible carrier (excludes Cricket & select others) on their term agmt or device plan (excludes 3rd party agmts). Must buy elig. smartphone in same transaction. Elig. Purchase/Svc: Smartphone on AT&T Next or AT&T Next Every Year installment agmt w/elig. svc (excludes prepaid, Lifeline, Residential Wireless and select discounted plans). Acct & svc must remain active & in good standing for 45 days. Tax due at sale. Down payment may be req'd. If svc is cancelled, installment agmt balance (up to $950) is due. Limit: Purch. limits apply. Trade-in: Select locations. Must be smartphone on line ported, be in good working condition w/min. $5 trade-in value & meet AT&T Trade-In program reqmts. Trade-in Credit: Instant credit or AT&T VISA Promotion Card issued by MetaBank™ or CenterState Bank of Florida NA, via license from Visa U.S.A. Inc. (may take 3 weeks to receive). Not redeemable for cash & non-transferable. Credit/Card valid for 5 months & for use only to purch. AT&T products & svc in AT&T owned retail stores, at att.com, or to pay wireless bill. Add'l cardholder terms & conditions apply & are provided w/Promotion Card. At dealers get credit (w/add'l terms) for use at dealer. Final Bill: Must go to att.com/helpyouswitch & upload or mail final bill w/in 60 days showing Early Termination Fee (ETF) or device plan balance (incl. lease purch. costs) on number ported. Final Credit: Total amount equals device balance/ETF (excludes taxes, fees, svc & other charges) up to $650 minus trade-in. Get up to $645 for device plan balance or up to $345 for ETF. W/in 4 wks after meet all elig. reqmts, will be mailed AT&T VISA Promotion Card issued by MetaBank™ or CenterState Bank of Florida NA, via license from Visa U.S.A. Inc. Not redeemable for cash & non-transferable. For use at US locations where Visa cards are accepted through date printed on card (min. 150 days). Add'l cardholder terms & conditions apply & are provided w/Promotion Card. See att.com/switch for details.

Gen. Wireless SVC: Subj. to Wireless Customer Agmt (att.com/wca). Svcs not for resale. Deposit may be reqd. Credit approval, activ., other fees, monthly, overage, other charges, usage, other restrs apply. Pricing & terms subject to change & may be modified or terminated at any time without notice. Coverage & svc not avail. everywhere. You get an off-net (roaming) usage allowance for each svc. If you exceed the allowance, your svc(s) may be restricted or terminated. Other restrs apply & may result in svc termination.

With AT&T’s Unlimited Data Plans1, you can enjoy unlimited streaming and surfing on all your devices on America’s best data network2.

Find Your Perfect Vehicle Match with Union Plus

* Between 7/1/16 and 9/30/16, the average estimated savings off MSRP presented by TrueCar Certified Dealers to users of TrueCar powered websites, based on users who configured virtual vehicles and who TrueCar identified as purchasing a new vehicle of the same make and model listed on the certificate from a Certified Dealer as of 10/31/2016, was $3,106. Your actual savings may vary based on multiple factors including the vehicle you select, region, dealer, and applicable vehicle specific manufacturer incentives which are subject to change. The Manufacturer's Suggested Retail Price ("MSRP") is determined by the manufacturer, and may not reflect the price at which vehicles are generally sold in the dealer's trade area as not all vehicles are sold at MSRP. Each dealer sets its own pricing. Your actual purchase price is negotiated between you and the dealer. TrueCar does not sell or lease motor vehicles.

**EPA Green Car Make and Models Include:

- Chevrolet — Cruze, Cruze Diesel, Malibu and Sonic

- Chrysler — 200

- Ford — Focus and C-Max

Searching for a new vehicle can be overwhelming! So get some free help finding the right new or used car or truck for you and your family. Check out this video to see what the Union Plus Auto Buying Service, administered by TrueCar™, has to offer you.

Beware the Hidden Costs of Homeownership

Home Insurance

At closing, you may have been required to pre-purchase a year of homeowner's insurance. Homeowner’s insurance often costs quite a bit more than renter’s insurance, because it covers the home, in addition to your personal property. Depending upon where you live, you may also need to purchase supplemental insurance for hurricanes, floors, tornadoes, earthquakes, and other natural disasters that are not covered under your standard policy. In addition, if you own any valuable items, such as sports memorabilia or jewelry, you may want to add coverage specifically for those items.

Maintenance and Repairs

Owning a home also means that you are responsible for all maintenance and repairs. These costs can add up quickly, especially in an older home with older systems. These expenses can include the cost to repair or replace appliances, heating and cooling systems, exteriors, and anything else that needs to be fixed. Every year, you should expect to spend some money on routine maintenance, and always keep an emergency fund with money available for emergency repairs. Keeping up with routine maintenance, although expensive in the short-term, will ultimately save you money in the long-term.

Home Utilities

Also prepare to spend some additional money on utilities, including water, garbage collection, heat, and electricity. With more space, it’s likely that even the bills you paid when you rented will be higher in your new home.

Homeowners’ Association Fees

Many communities have a homeowners’ association, commonly called an HOA. An HOA is typically tasked with maintaining common areas and enforcing deed restrictions. Membership in a community HOA is often mandatory and members are charged a monthly or annual fee.

Home Furnishings

Finally, keep in mind that you’ll need to purchase furniture and décor items for your new home. Most people, when purchasing a new home, decide to paint, upgrade the décor, purchase new furniture, and buy new linens.

When purchasing a new home, factor in these items to your total budget to make sure that you are completely financially prepared for homeownership. By doing this, you’ll know that you are purchasing a home that you can afford.

Union Plus Credit Counseling

Union members can get a no-obligation money and credit assessment from certified, experienced consumer credit counselors though Union Plus Credit Counseling. Powered by the non-profit Money Management International (MMI), your free session will cover a complete financial review, assistance in budgeting, advice for working with creditors, and more.

Are you planning to buy a new home? If you are making the move from renter to homebuyer, you are likely to find that there are some hidden costs to ownership — costs that you probably never thought about when you were renting. Starting at your closing, additional housing expenses that you hadn’t considered might cost you money you were never expecting to spend.

Improve Your Chances of Getting a Loan by Learning What Lenders Look For

Through the Union Plus® Mortgage program, with financing provided by Wells Fargo Home Mortgage, union members, their parents and children have access to a wide range of home loan options to meet a variety of needs, plus access to special benefits designed for union families.

When you apply for a loan, lenders assess your credit risk based on a number of factors, including your credit/payment history, income, and overall financial situation. Here is some additional information to help explain these factors, also known as the “5 Cs,” to help you better understand what lenders look for:

- Credit history: Qualifying for the different types of credit hinges largely on your credit history – the track record you’ve established while managing credit and making payments over time. Your credit report is primarily a detailed list of your credit history, consisting of information provided by lenders that have extended credit to you. While information may vary from one credit reporting agency to another, the credit reports include the same types of information, such as the names of lenders that have extended credit to you, types of credit you have, your payment history, and more.

In addition to the credit report, lenders may also use a credit score that is a numeric value – usually between 300 and 850 – based on the information contained in your credit report. The credit score serves as a risk indicator for the lender based on your credit history. Generally, the higher the score, the lower the risk. Credit bureau scores are often called “FICO® scores” because many credit bureau scores used in the U.S. are produced from software developed by Fair Isaac Corporation (FICO). While many lenders use credit scores to help them make their lending decisions, each lender has its own criteria, depending on the level of risk it finds acceptable for a given credit product.

- Capacity: Lenders need to determine whether you can comfortably afford your payments. Your income and employment history are good indicators of your ability to repay outstanding debt. Income amount, stability, and type of income may all be considered. The ratio of your current and any new debt as compared to your before-tax income, known as debt-to-income ratio (DTI), may be evaluated.

- Collateral (when applying for secured loans): Loans, lines of credit, or credit cards you apply for may be secured or unsecured. With a secured product, such as an auto or home equity loan, you pledge something you own as collateral.

The value of your collateral will be evaluated, and any existing debt secured by that collateral will be subtracted from the value. The remaining equity will play a factor in the lending decision.

- Capital: While your household income is expected to be the primary source of repayment, capital represents the savings, investments, and other assets that can help repay the loan. This can be helpful if you lose your job or experience other setbacks.

- Conditions: Lenders may want to know how you plan to use the money and will consider the loan’s purpose, such as whether the loan will be used to purchase a vehicle or other property. Other factors, such as environmental and economic conditions, may also be considered.

The 5 C’s of Credit is a common term in banking. Now that you know them, you can better prepare for the questions you may be asked the next time you apply for credit.

And remember, after closing on a loan through the Union Plus Mortgage program, you’ll be eligible for special benefits that include receiving a My Mortgage GiftSM award from Wells Fargo - $500 for buying a home or $300 for refinancing your home – for use at participating retailers, and access to mortgage assistance through Union Plus in times of hardship such as layoff, disability or strike.1 Keep in mind that parents and children of union members are also eligible for certain benefits.

Talk to a

Union Plus Mortgage Specialist

at 866-802-7307

or request a personal consultation

Source: wellsfargo.com

1Eligible individuals can receive the Wells Fargo My Mortgage GiftSMaward approximately 6 weeks after closing on a new purchase or refinance loan secured by an eligible first mortgage or deed of trust with Wells Fargo Home Mortgage (“New Loan”), subject to qualification, approval and closing, when identifying themselves as eligible. The My Mortgage GiftSM award is not available with any Wells Fargo Three-Step Refinance SYSTEM® program, The Relocation Mortgage Program® or to any Wells Fargo team member. Only one My Mortgage Gift award is permitted per eligible (“New Loan”). This award cannot be combined with any other award, discount or rebate, except for yourFirstMortgageSM. This award is void where prohibited, transferable, and subject to change or cancellation with no prior notice. Awards may constitute taxable income. Federal, state and local taxes, and any use of the award not otherwise specified in the Terms and Conditions (also provided at receipt of award) are the sole responsibility of the My Mortgage GiftSM recipient.

Wells Fargo Home Mortgage has a services agreement with Union Privilege in which Union Privilege receives a financial benefit for providing agreed upon services. You are encouraged to shop around to ensure you are receiving the services and loan terms that fit your home financing needs.

Information is accurate as of date of distribution. Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. © 2018 Wells Fargo Bank, N.A. All rights reserved. NMLSR ID 399801

![]()

When you apply for a loan, lenders assess your credit risk based on a number of factors, including your credit/payment history, income, and overall financial situation. Here is some additional information to help explain these factors, also known as the "5 Cs," to help you better understand what lenders look for:

How To Know If You Need Flood Insurance

It’s a good idea to think about flood insurance in advance of an event, because standard homeowners policies exclude flood coverage. You can find out whether your property is in a low-, moderate- or high-risk flood area by entering your address into the Federal Emergency Management Agency (FEMA) database. Keep in mind, however, that 25 percent of all flood claims are from people who don’t live in high-risk areas. And because of the recent boom in new housing developments, the land’s natural runoff pattern might have changed from what a 10-year-old flood map shows.

MetLife Auto & Home is proud to offer our customers flood insurance through the National Flood Insurance Program (NFIP) and Federal Emergency Management Agency (FEMA), and it covers more than just the structure of your home. It also covers debris removal, damage to your contents and more. Contact your local MetLife Auto & Home representative or call one of our flood specialists toll free at 855-666-5797.

L0915436452[exp0917][All States][DC]

MetLife Auto & Home offers flood policies through the National Flood Insurance Program (NFIP) and Federal Emergency Management Agency (FEMA), covering your home’s structure and any debris removal necessary.

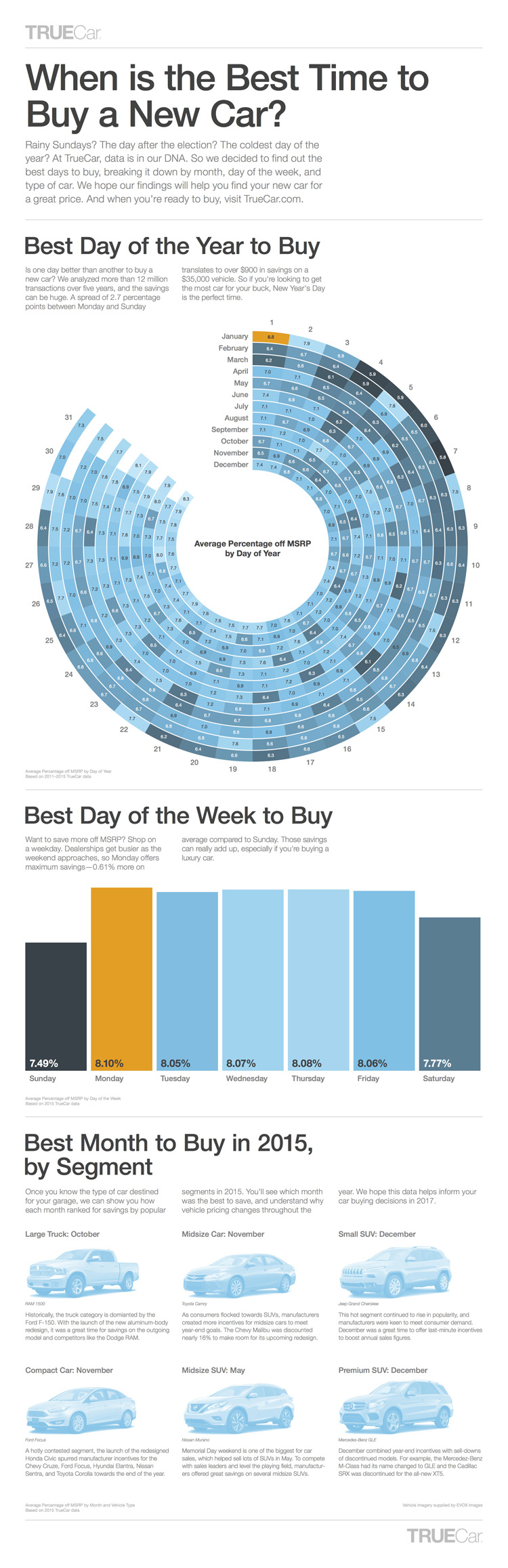

The Data Behind the Best Times to Buy a New Car

Car prices change all the time, for all kinds of reasons. Using industry sales data from previous years, the experts at TrueCar identified the best times to buy a new car by month, day and even segment.

TrueCar, which powers the Union Plus Auto Buying Service, has analyzed more than 12 million transactions over five years to determine which day of the year is the best to buy a vehicle. The savings can be huge!